Flexible Offices Are India’s New GCC Control Layer

Flexible office networks have quietly become the strategic control layer for Global Capability Centre (GCC) expansion in India. What looks like a real estate decision is, in practice, a mechanism for managing uncertainty across capital, geography, talent, and regulatory exposure.

- Flex offices convert GCC entry from a long-term commitment into a reversible operating experiment.

- Their real value lies less in cost savings and more in accelerated learning and risk sequencing.

- Flex economics invert sharply at scale, creating a transition cliff that many GCCs fail to plan for.

- Operator concentration is reintroducing dependency risk under a different name.

Why this matters now

India hosts over 1,800 GCCs, employs ~2 million professionals, and generates $64.6 billion in annual GCC revenue, with projected value growth of 12% CAGR through FY29. As flexible workspaces absorb 72% of international demand and account for ~15% of new office leasing, flex is no longer optional. The strategic error today is not using flex. It is using it without an exit logic.

How can multinational enterprises enter and scale GCC operations in India while minimizing irreversible bets on capital, location, and operating structure?

Why this question matters

The traditional GCC model assumed stability: predictable mandates, steady headcount growth, and long-term real estate commitments. That assumption no longer holds. India’s GCC market is shifting from cost arbitrage to innovation-led mandates, increasing volatility in talent demand, compliance exposure, and speed expectations.

Flexible offices have emerged not as a workaround, but as the system that absorbs this volatility.

Market Context: Why Flex Became the Default, Not an Alternative

India’s flexible workspace market has crossed a structural threshold. Growing at a 24% CAGR, flex inventory expanded from 29.3 MSF in 2020 to 85 MSF in 2024 and is projected to exceed 100 MSF by 2026. Crucially, this growth is not startup-led. International GCC demand accounted for 72% of flex seat absorption in 2024, and flex now represents ~15% of total new office leasing in India (Economic Times).

Interpretation

This is not a cyclical rebound or a hybrid-work artifact. Flex has become the default entry infrastructure for global enterprises because it aligns with how GCC mandates are now deployed: faster, less certain, and more distributed.

Bengaluru’s dominance, with ~30% of national flex inventory and one-third of enterprise transactions, reflects talent gravity rather than cost arbitrage. Delhi-NCR, Pune, and Hyderabad operate as secondary anchors. But the more important signal lies elsewhere.

Tier-2 and Tier-3 cities, including Kochi, Trivandrum, Coimbatore, Chandigarh, Jaipur, Visakhapatnam, and Bhubaneswar, are no longer fringe bets. Managed office models have lowered the coordination, compliance, and setup costs enough to make these cities viable testing grounds rather than long-term commitments (Cushman & Wakefield).

Implication

Flex did not grow because companies wanted flexibility. It grew because it removed the penalty for being wrong about location.

1. Flex Offices Turn Market Entry into a Reversible Decision

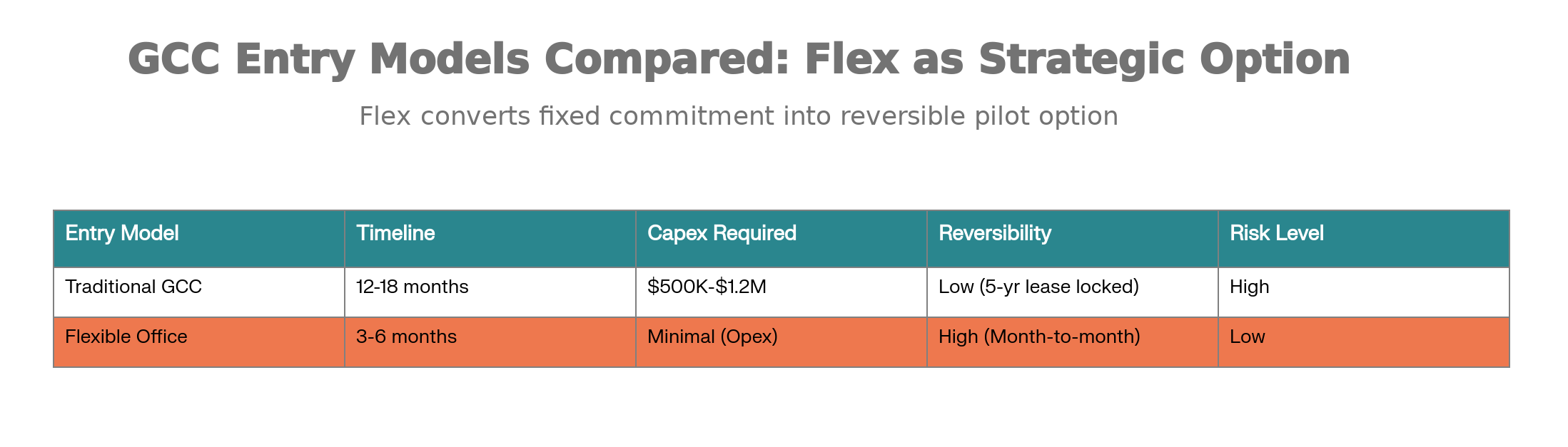

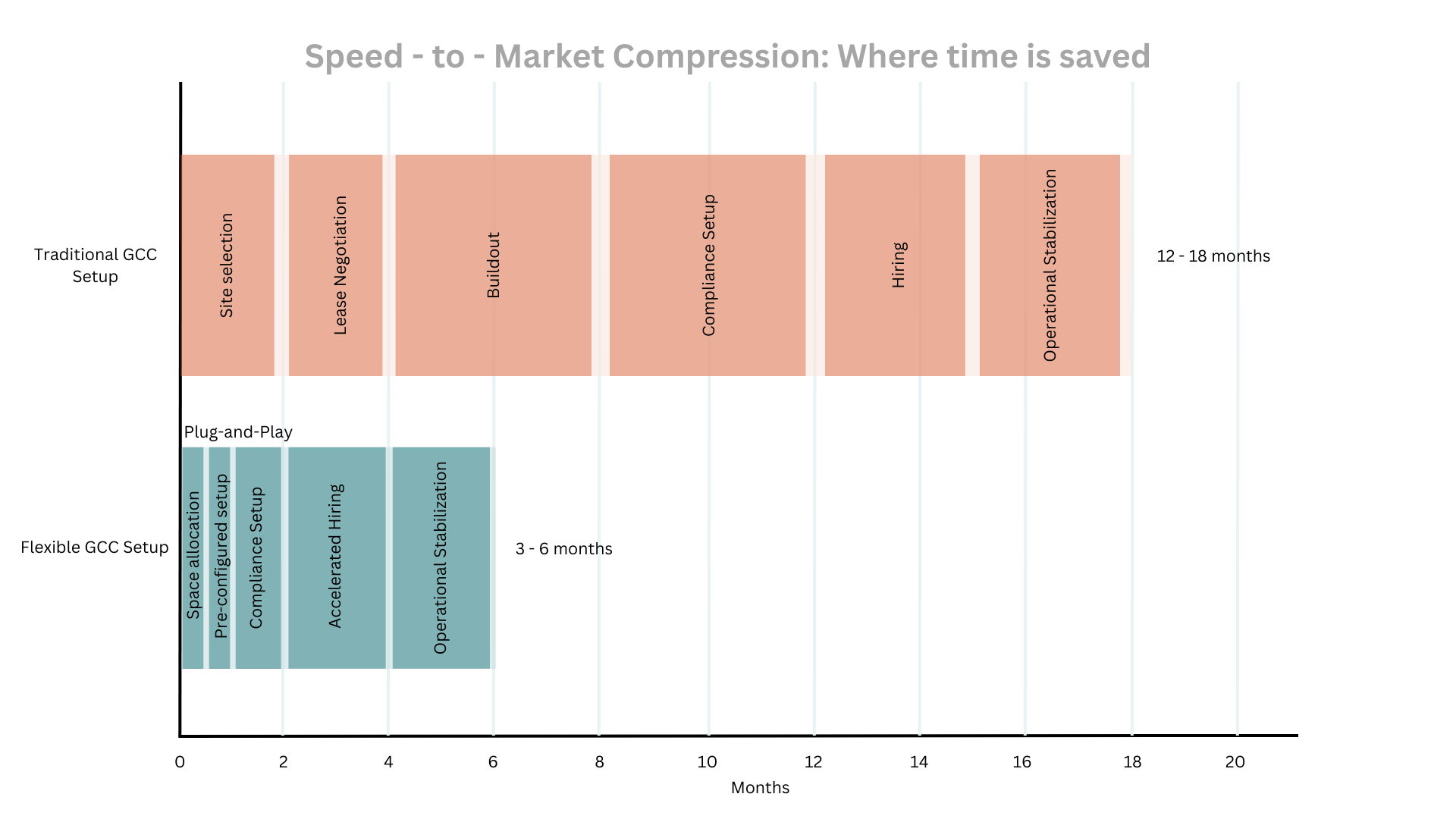

Traditional GCC setup requires 12–18 months across site selection, leasing, buildout, compliance, hiring, and stabilization. Flexible office models compress this to 3–6 months through plug-and-play infrastructure, pre-configured compliance frameworks, and embedded vendor and staffing networks.

Interpretation

The critical shift is not speed. It is reversibility. Flex allows companies to enter India without locking assumptions about scale, city, or mandate into five-year leases.

Implication

Early-stage GCCs should be framed internally as live pilots, not “Phase 1 campuses.” Governance, KPIs, and success criteria should reflect learning velocity, not footprint size.

2. Capital Efficiency Functions as Risk Management, Not Cost Cutting

Traditional GCC entry requires $500,000–$1.2 million in upfront capital for infrastructure, systems, and compliance scaffolding. Flex models convert this into a variable, per-seat opex structure with no long-term commitment.

According to Cushman & Wakefield, 57% of companies using managed office solutions reported major fit-out and maintenance savings, with all-in per-seat costs 30–50% lower at early stages.

Interpretation

This is not primarily a savings story. It is a mistake-avoidance story. Flex protects firms from being confidently wrong too early.

Implication

Finance leaders should evaluate flex through a risk-adjusted lens: What capital commitments does this structure allow us to delay or avoid?

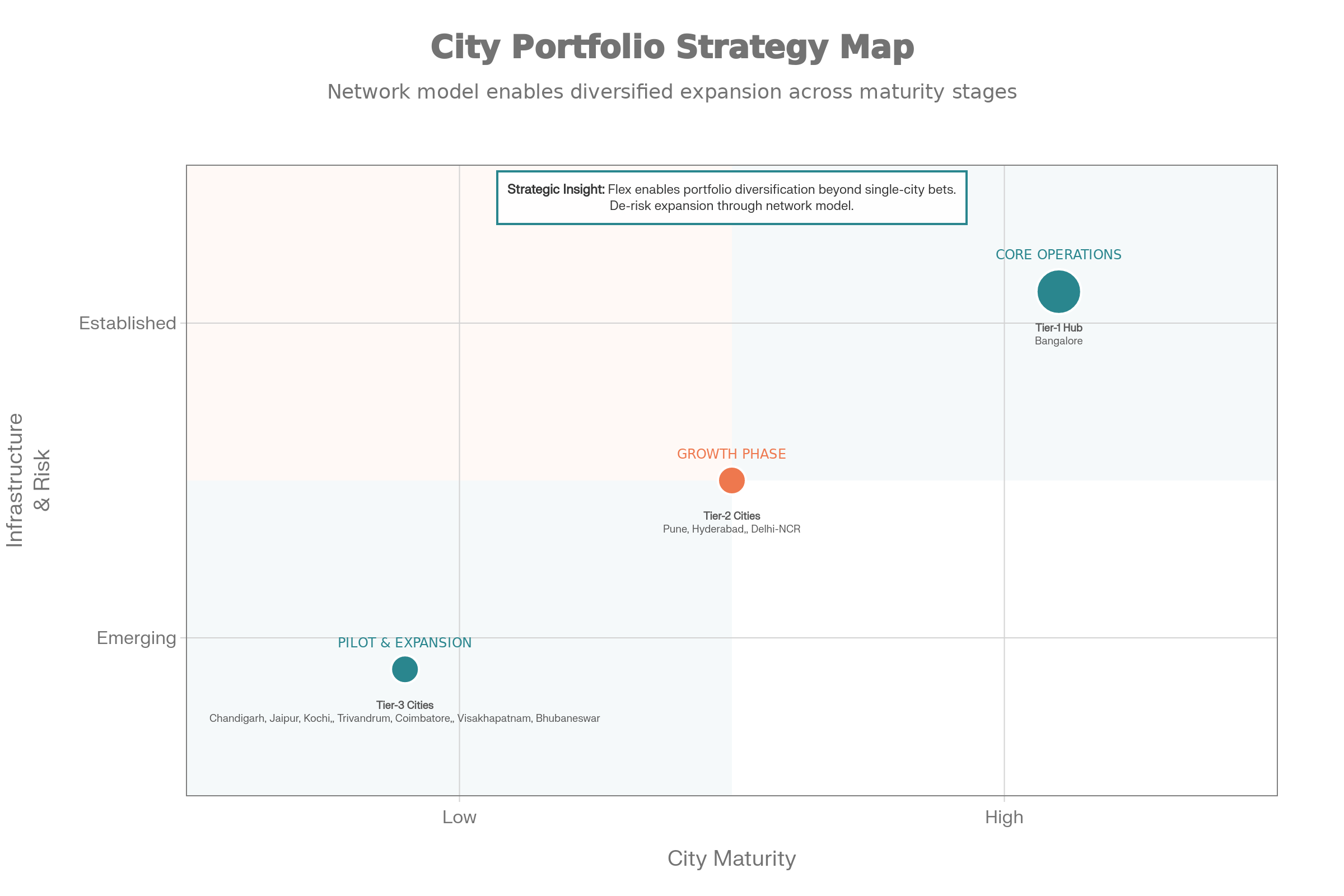

3. Flex Networks Enable Geographic Optionality, Not Just Expansion

Bengaluru dominates with ~30% of national flex inventory, followed by Delhi-NCR, Pune, and Hyderabad. But the real shift is the emergence of Tier-2 and Tier-3 cities such as Kochi, Trivandrum, Coimbatore, and Bhubaneswar as viable GCC locations, enabled directly by managed office models.

Interpretation

Flex networks spanning 10–15 cities turn location strategy into a portfolio decision rather than a single-city bet.

Implication

GCC leaders should stop asking “Which city?” and start asking “Which mix of cities lets us test talent depth, cost, and attrition with minimal lock-in?”

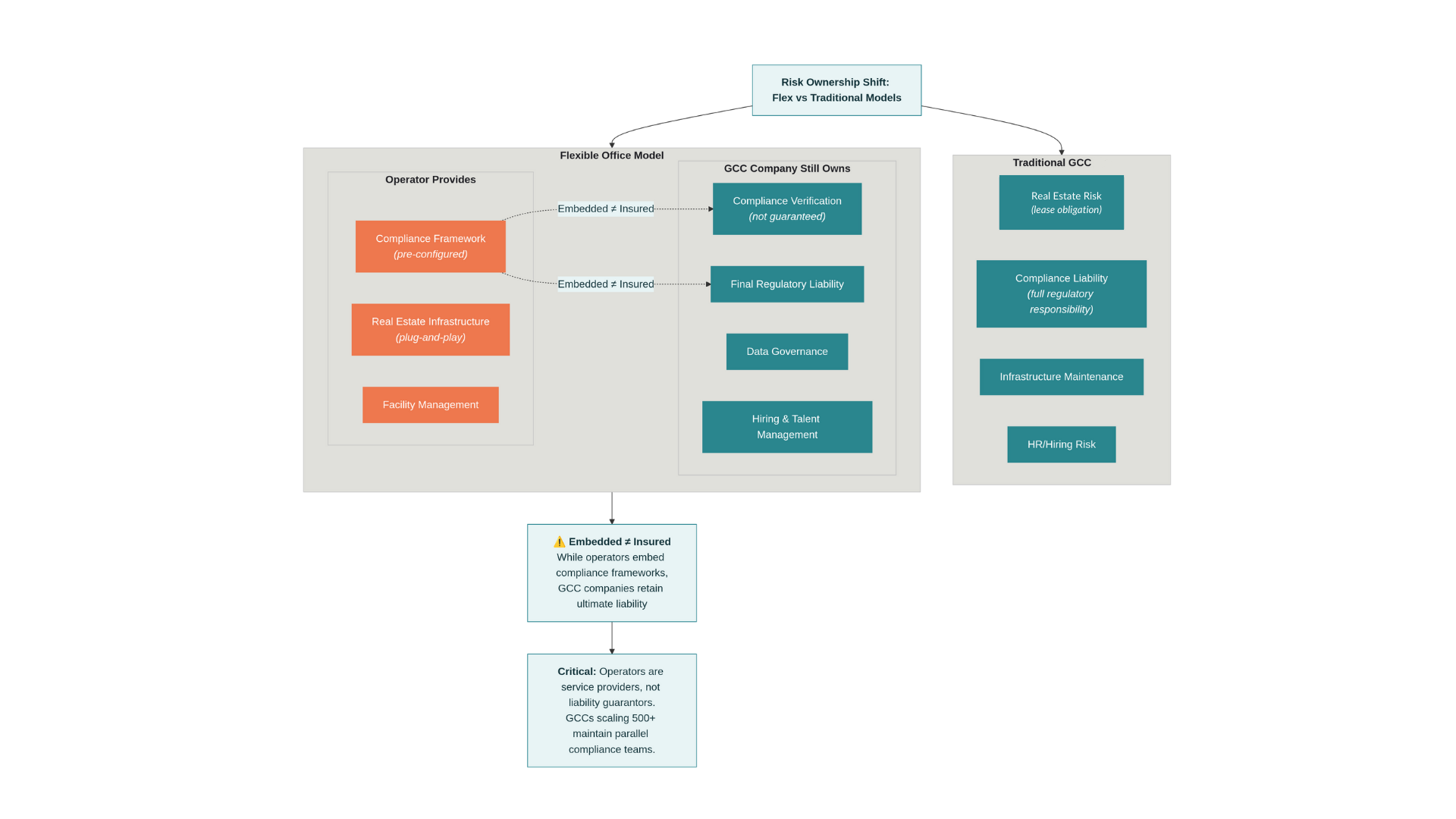

4. Operational Derisking Has a Shelf Life

Flexible office operators embed compliance frameworks covering data residency, security protocols, and labor law requirements, significantly reducing setup friction.

However, regulatory liability ultimately remains with the GCC. As centres scale beyond ~500 employees and take on R&D or core product development, compliance risk increases non-linearly.

Interpretation

Flex derisks entry, not maturity.

Implication

High-performing GCCs begin building parallel internal compliance oversight well before scale forces the issue.

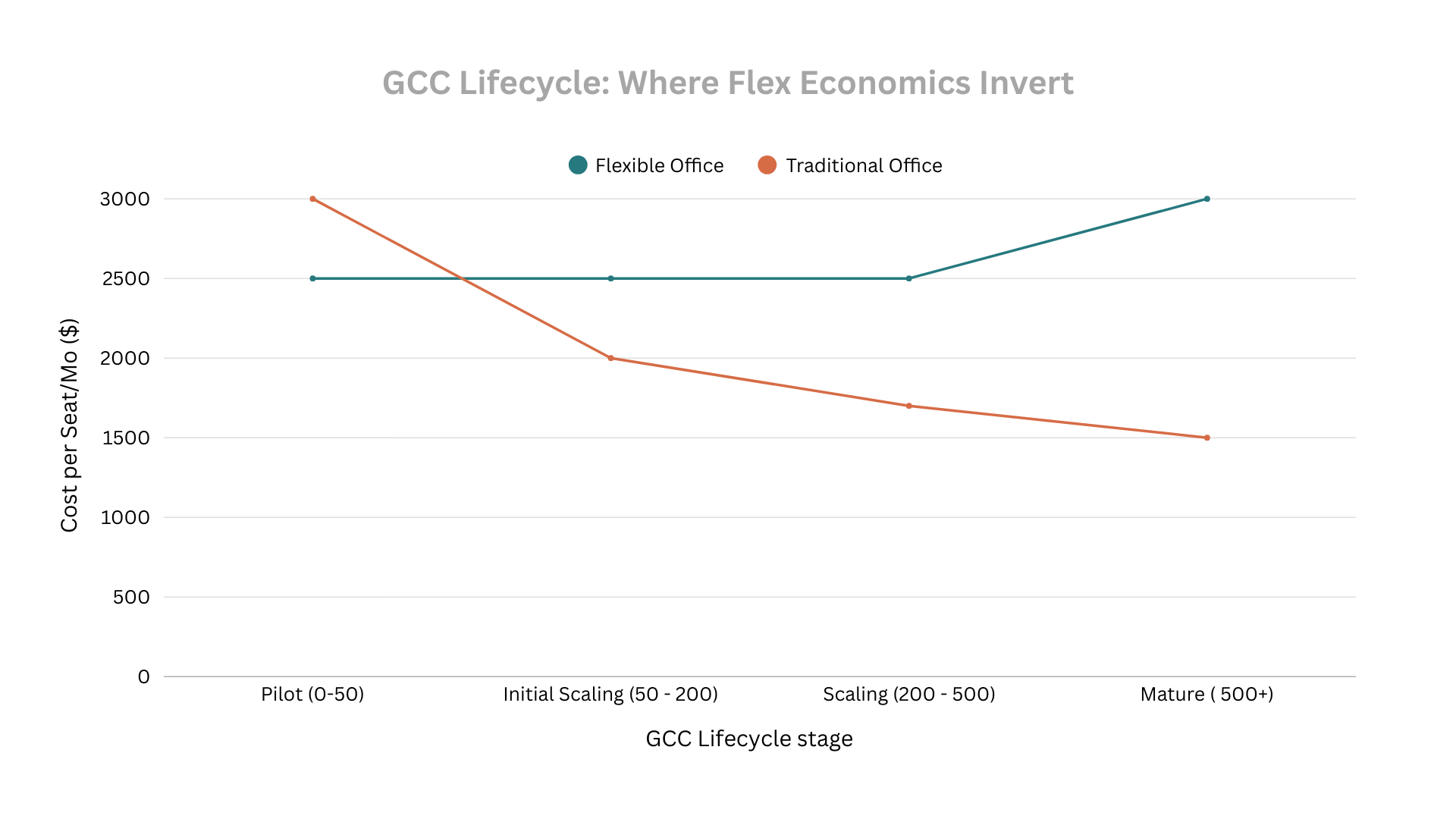

5. The Flex-to-Permanent Transition Is a Structural Cliff

Once GCCs reach approximately 300–500 employees, per-seat flex costs exceed permanent office economics. This creates an economic inflection point that many organizations reach without preparation.

Interpretation

Flex optimizes for speed and adaptability, not long-term efficiency.

Implication

The transition strategy should be designed at entry. Treating it as a future problem guarantees disruption.

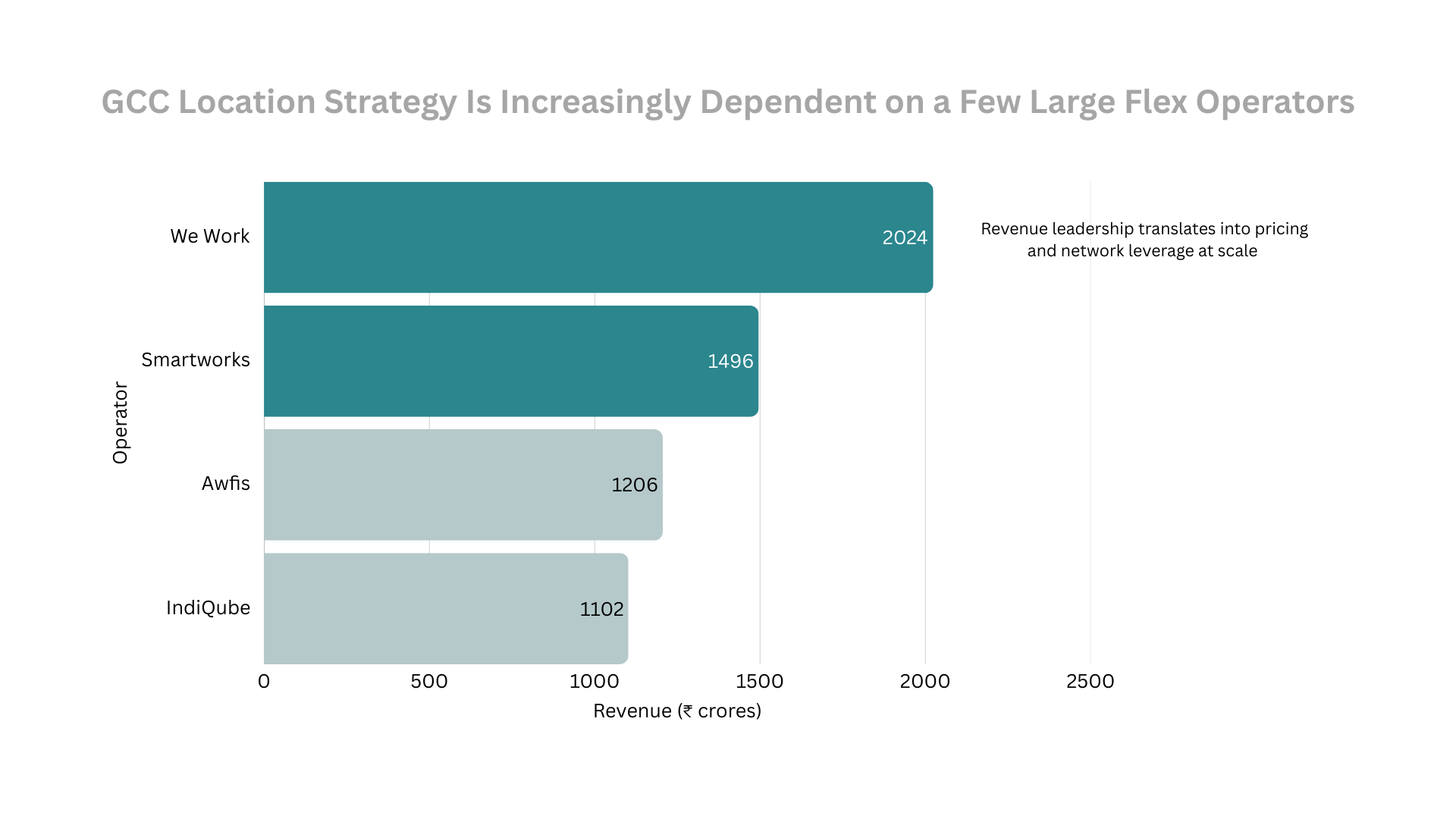

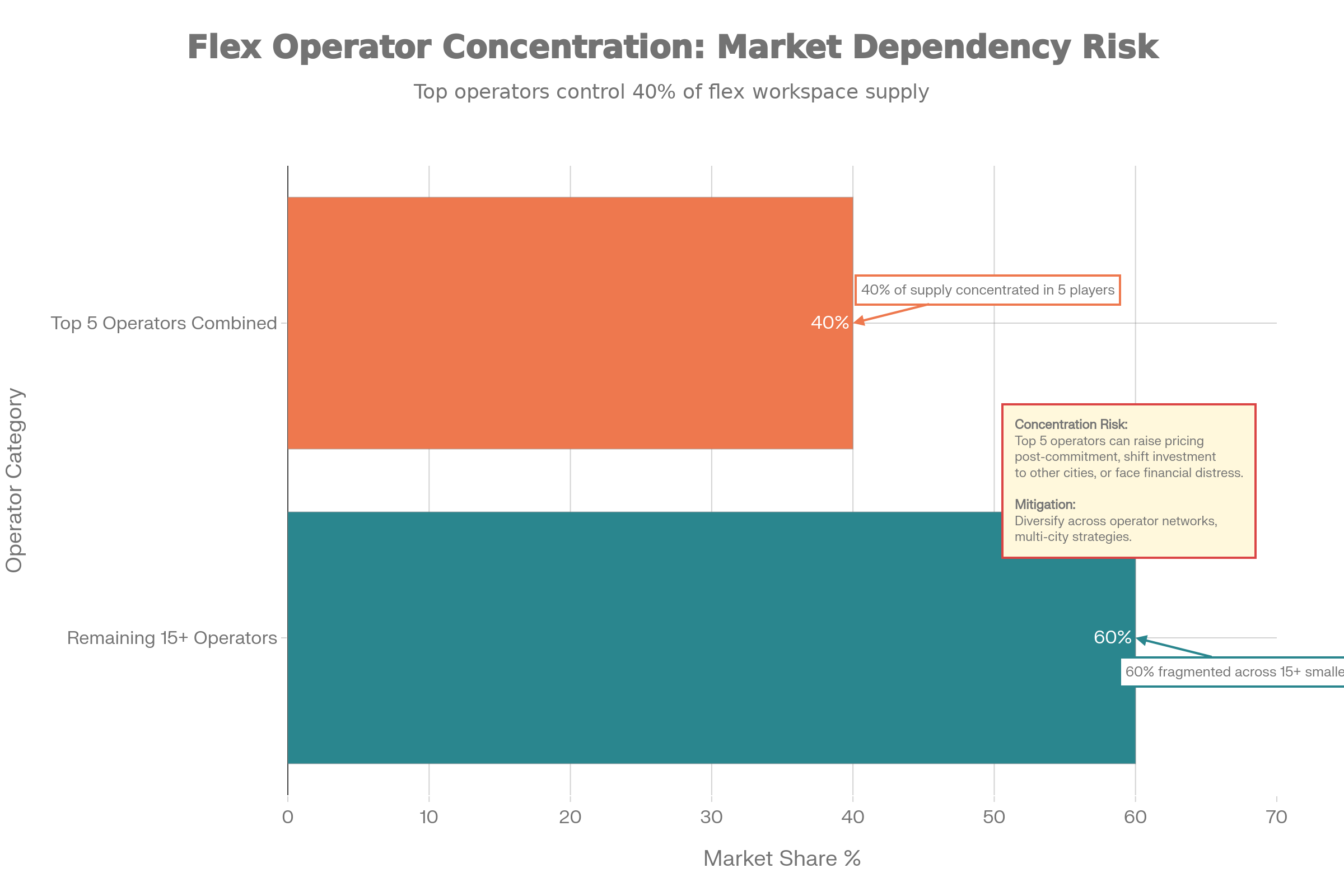

6. Operator Concentration Reintroduces Dependency Risk

The top five flex operators control roughly 40% of supply. This creates pricing power, network dependency, and exposure to operator-specific financial or strategic decisions.

Interpretation

Flex has shifted dependency from landlords to platforms.

Implication

Multi-operator strategies are no longer optional. They are a governance requirement for large or fast-scaling GCCs.

Synthesis & Implications

Collectively, the research points to a reframing of flexible offices: not as space, but as infrastructure for uncertainty. Flex works best when treated as a deliberate phase in the GCC lifecycle, with clear entry objectives and exit criteria.

The dominant model emerging is not flex or permanent, but flex then permanent, with intent.

Decision-Level Takeaways

- Decide whether your GCC entry is an experiment or a commitment. Design space accordingly.

- Evaluate flex through avoided risk, not headline cost.

- Plan the flex-to-permanent transition at day one.

- Use city portfolios to test talent elasticity, not chase arbitrage.

- Build internal compliance capability before scale exposes gaps.

- Diversify operators early to prevent silent lock-in.

Co-Authored by Vidhi Gupta

Sources: